Maximising opportunities and mitigating risks. Create, grow and protect your legacy.

A family office is a special organization – one that possesses advantages against the increasingly complicated environment of family wealth management. To ensure your family legacy flourishes and stands firm over the long term, keep these fundamental areas in mind.

Investment management and associated finance and administration functions are often core functions, but an SFO’s activities may include other activities which are not limited to:

Family

Investments

Tax & Wealth Planning

Risk Management

Strategic Services

Philanthropy

Technology

Legal

Finance

Operations

Recently, Asia has seen an exponential growth of SFOs which correlates to the phenomenal economic rise of Asia – the data shows that the accumulation of wealth by families in Asia is faster than in any other region of the world. Family offices have therefore naturally developed to manage this wealth expansion. This rise in wealth has also brought with it the need for proper succession planning–an issue many Asian families continue to grapple with–and which family offices can assist to manage with the support of professional service providers.

Between 2017 and 2019, the number of SFOs had increased by fivefold, as estimated by the Monetary Authority of Singapore (MAS).

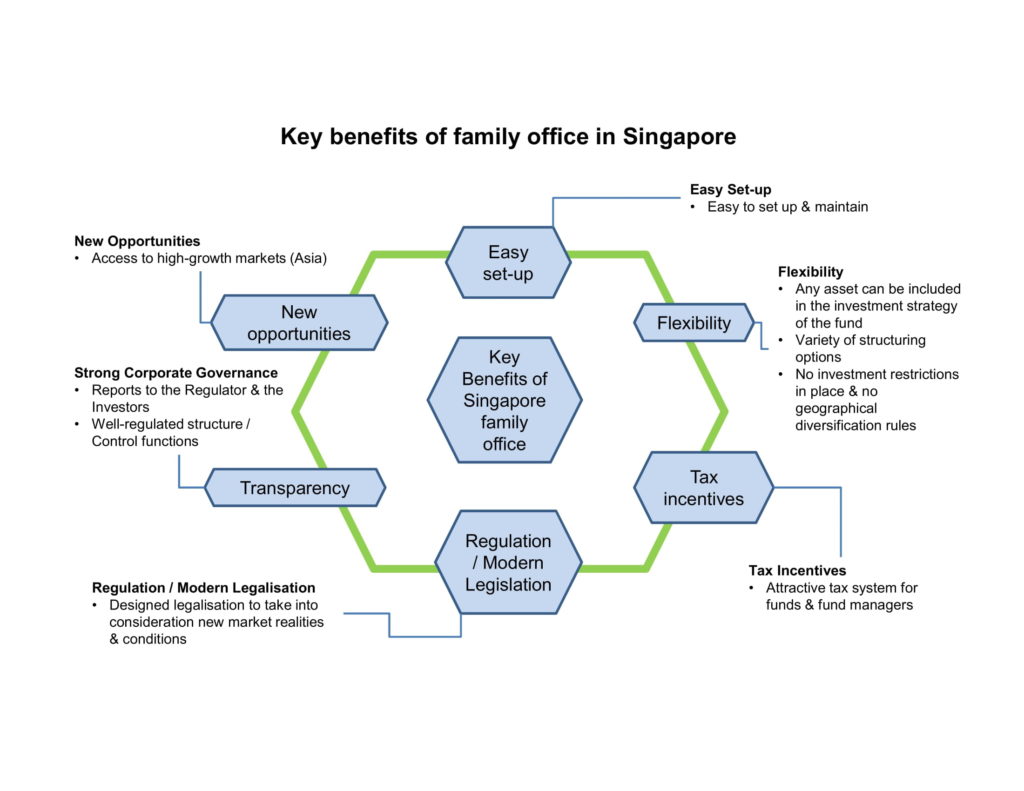

Today, Singapore is globally-known as one of the most business-friendly jurisdictions in the world. This is due to a combination of factors such as political stability, a trusted legal system, high-quality infrastructure, openness to foreign talent, and an attractive tax regime that has made Singapore a global hub for corporate and financial services activities. The past two decades has seen Singapore grow rapidly in its wealth management industry, which has led to the development of a supportive and sophisticated financial, legal, tax, and human infrastructure.

As a result, Singapore is already home to many sophisticated wealth management entities including Single Family Offices (SFOs).

Singapore is well-known for having one of the most competitive tax regimes internationally. From flat rate corporate tax at 17% to individual tax rate fat a maximum of only 22%. Unlike other developed countries, Singapore does not levy any capital gains or estate tax or tax on foreign-sourced income in the hands of individuals.

Finally, Singapore is party to an extensive network of double tax treaties, and a substantial number of investment treaties, which further strengthens its standing as a leading private wealth management hub. Funds managed by an SFO in Singapore can enjoy tax exemption on income, specifically under the fund management tax incentives granted under Sections 13CA, 13O, and 13U of the Income Tax Act. These exemptions are subject to approval from the MAS.

Generate greater returns, successfully minimise risks, build trust and shock-resilience by being proactive and using your family values as assets to achieve total impact and stay relevant.

Keep everyone on the same page by codifying your family’s values, goal and direction and make sure your family code is understood, accepted and shared by everyone.

We use your code to inform all decisions and areas of your family office to guarantee better returns from your investment strategy as well as having a positive impact on partners, the wider community and environment. We provide support from helping you to build your family code and advise you on sustainable investments, impact investing, philanthropy activities and many more.

Making decisions quickly in an informed and agile manner under pressure is essential to managing and combating uncertainty and unexpected situations while seizing opportunities.

Managing a family portfolio has become increasingly more complex. From having the right governance and a sound management structure allowing for nimble decision-making to possessing the means to analyse, present and make use of accurate, relevant and timely data, it’s no easy feat. Not to mention, the growing need to be future-proof through digital transformation.

To structure your family office to be agile and efficient, we make use of specifically designed technology to help you identify and design the best solutions to grant you seamless access to the data you need. We also help you to manage and analyse all information around your wealth as well as ensuring your data is safe and secure.

The “best” today may not be the “best” tomorrow. This applies to any leading practice applied in a myriad of areas such as governance, investment strategies, business models, recruitment and retention and so on.

In order to stay competitive and relevant in today’s fast-changing world, we help you make use of current leading practices and keep up to date with new trends and processes to ensure maximum efficiency. The knowledge of our talented experts across different areas will support you to create your family office or advise you on a particular area or need.

To protect your family office from today’s volatile and ever-changing times, your safety and risk management, including your strategies and tools involved, need to be prioritised.

Be holistic in your approach towards the increasing and complex risk scenarios which go beyond the traditional disciplines. These include technological advancements, cyber security, privacy, compliance and succession planning, climate change, transparency, reputation and digital transformation.

Supporting you with many of the world’s advisers and thought leaders on the different disciplines, we give you access to their capabilities and expertise to keep your business safe and secure.

Our service offerings are catered to helping you effectively utilise the 4 Keys to build, manage and protect your family legacy. With a defined vision, goal and purpose of your office, we use this foundation to construct each aspect to support your legacy.

Through extensive research and interviews, we help you to create an overall and comprehensive plan which involves key areas, including operations, staffing needs, technology and governance, built around you and your needs.

No matter your requirements, we help you to build a family office of and for the future, a structure that best suits your legacy.

Starting from scratch may seem like a daunting task but it doesn’t need to be. Our 4 steps guide provides you with a complete document that helps you to break down the process into sizable steps.

Creating a successful family office has several moving parts. Possessing years of experience, we help you step by step – from initial assessment to vision to plans and implementation. In addition, our experts are on hand to assist.

Together, you’ll have a custom plan to manage the challenges that come with a family office.

Identifying your needs, expectations and your options available

Start by defining your vision and purpose for your family and its wealth. Once this is done, we’ll help you build the structure of a family office and ensure a seamless operation. We will conduct extensive reviews through research and interviews with select family members in the effort to understand your past, current and future vision. These details will help create an overall plan with key areas that include operations, technology, staffing needs, advisers and governance that is truly built around your needs to ensure that your family office is future-ready and shock resilient.

Creating the structure

Once you have made the decision to set up the Single Family Office, we move on to creating its structure which will include:

– Outlining legal and tax structures

– Governance Planning

– Fund Allocation and costs

– Identifying core services (in-house and outsourced)

– Addressing operations and technology needs

– Staffing requirements

– Budgeting

– Establishing reporting requirements

– Ensure proper controls are in place

– Identifying technology needs

select and contract vendors and support

– Identify facilities

– Design communication and reporting protocols

– Write job descriptions

– Structure reporting processes

Execution

With a plan in place, you are ready to set up your Single Family Office. This stage will involve the implementation of all activities, from setting up policies and procedures, legal structures, hiring staff, refining financial models to the actual office set up, including IT infrastructure and cybersecurity.

Management of your Family Office

Now that your family office is set up, it is important to review its operations regularly against leading practice and your objectives. It is also worth investing in refining and building some of its functions and digital capabilities.

It’s through curiosity and looking at opportunities in new ways that we’ve always mapped our path.

Setting up and maintenance costs, as well as compliance with policies across jurisdictions, can be high and will need to be balanced against the amount of assets under the management.

It is important to set up the right structure in the right jurisdiction and is best suited to meet the family’s objectives across jurisdictions, generations, and types and geographical locations of assets held.

There may be a loss of confidentiality across units due to consolidation of the family wealth. To mitigate this, appropriate structuring is important.

Outsourcing functions may increase efficiency but could also increase costs as well. Keeping as many functions in-house may help to keep a lid on costs and maintain confidentiality, but only if capable and qualified family members are available and willing to step up. Direct control over the assets are also maintained if functions are kept in-house.

Whether or not to keep the family trust and family office together or separately is something to consider depending on both short and long term objectives and also depends on legal and tax implications.

Our experts will then be able to better provide you with the services you need.

Understanding your concerns, every step.

Decades of expertise, yours to leverage.

One-Stop for all your business needs.

#23-05 A , Peninsula Plaza

111, North Bridge Road

Singapore 179098

Mr. Jayapal Ramasamy

Mobile phone: +65 9017 2065 / +65 9007 0005

Email: jayapal@mcmillanwoods.com.sg

Email: yiyong.kan@mcmsfo.com

Hungary

Poland

Romania

Switzerland

EASTERN EUROPE

Azerbaijan

Cyprus

Turkey

Ukraine

WESTERN EUROPE

Germany

Luxembourg

Netherlands

Spain

United Kingdom

NORTHERN EUROPE

Denmark

Estonia

Latvia

SOUTHERN EUROPE

Bosnia/Herzegovina

Italy

Malta

Portugal

Serbia